Mexico recently overtook China as the United States’ largest trading partner, marking a significant milestone in the North American trade relations. This shift reflects changes in global trade dynamics and reflects that many companies are taking the decision of manufacturing in Mexico and selling to the U.S.

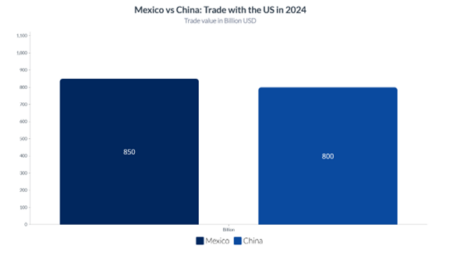

The Numbers Behind the Trend

In 2024, Mexico accounted for approximately 15.3% of total U.S. trade, surpassing China’s share of 12% to 13%. This includes increased exports from Mexico to the U.S., particularly in automobiles, machinery, and electronics, and a rise in U.S. exports to Mexico.

Source: Statista, 2024. https://www.statista.com/chart/20366/trade-volume-top-us-trade-partners/

Factors such as rising labor costs in China, the U.S.-China trade war, supply chain disruptions, and the benefits of nearshoring have all contributed to this change.

But how does Mexico stack up against China in terms of selling products to the U.S.? Let’s take a deep dive into the key differences and advantages of each.

1. Proximity and Logistics: A Key Competitive Advantage for Mexico

One of Mexico’s strongest advantages over China is its geographic proximity to the United States. The closer geographical distance between Mexico and the U.S. means that products can be transported land or sea much faster than goods shipped from China.

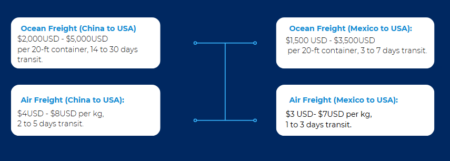

- Mexico to the U.S.: Transporting goods from Mexico to the U.S. is fast, with land shipments taking 3 to 7 days depending on the region. The established infrastructure along the U.S.-Mexico border allows for easy access to major U.S. markets such as California, Texas, and Arizona.

- China to the U.S.: Ocean freight from China to the U.S. can take 14 to 30 days, depending on the port and route.

Below you can find a cost and time comparison on ocean and air freight:

Sources: Container Shipping Cost Calculator [2024] – Freightos & International Container Shipping | Online Freight Marketplace

2.Tariffs and Trade Agreements: USMCA vs. Tariffs

The trade relationship between the U.S. and Mexico is governed by the United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA in 2020. The agreement provides duty-free access for most goods moving between the U.S. and Mexico, provided they meet certain rules of origin.

- Mexico (USMCA): Due to the USMCA, companies manufacturing in Mexico and selling to the U.S. can take advantage of the reduction or exemption of tariffs. Which is also a factor that provides an attractive option for businesses looking to avoid tariffs that might be imposed on goods from other regions.

- China (Tariffs): Trade tensions between the U.S. and China have led to the imposition of tariffs on several Chinese goods. These tariffs can make Chinese goods significantly more expensive, reducing their competitiveness in the U.S. market compared to products from Mexico, which generally enter tariff-free under USMCA.

3. Labor Costs and Manufacturing Efficiency

Labor costs play a pivotal role in determining the overall competitiveness of products sold to the U.S. In the past, China was seen as the go-to destination for low-cost manufacturing. However, wages in China have risen steadily over the years, narrowing the gap between Chinese labor costs and those in other countries, including Mexico.

The average manufacturing wage in Mexico is approximately $2.60 to $4.80 per hour, depending on the role and sector. In contrast, labor costs in China have increased steadily, with hourly wages exceeding $6.50 per hour.

4. Manufacturing Clusters and Industry Specialization

Both Mexico and China have developed strong manufacturing sectors, but their strengths differ by industry. While China is known for its electronics and textiles, Mexico has become a major hub for automotive manufacturing, aerospace, electronics, and medical devices.

5. Intellectual Property

Furthermore, it is considered that manufacturing in Mexico count with a lower risk of intellectual property theft than in China. Still both countries have strong work to do in intellectual property protection matters.

What’s Next in regards to manufacturing in Mexico?

The dynamics of global trade have shifted, and for many companies, Mexico is proving to be a more advantageous option for selling products to the U.S. than China. While China remains a dominant player in many sectors, the trade war, rising labor costs, and increasing geopolitical risks have made it a less attractive option for U.S.-bound goods in recent years.

Politics in each country play a very important role, as if import duties in United Sates are increased for products manufactured in Mexico, the scenario can change.

For foreign companies seeking cost-effective, efficient, and nearshore manufacturing, Mexico offers clear advantages in terms of speed, cost savings, and flexibility. As such, it’s no surprise that manufacturing companies are choosing Mexico over China for its manufacturing process and selling goods to the U.S. market.

In Mexcentrix we can help you by facilitating the process through a smooth start and running of operations. Contact us!