Trump intensifies trade war with threat of 30% tariffs on EU, Mexico

‘UNFAIR TREATMENT’

A Strategic Location in the Heart of Mexico

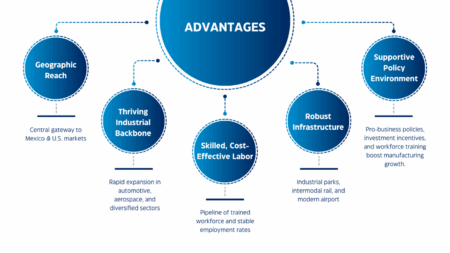

Nestled in the Bajío region, San Luis Potosí is within easy reach of major hubs like Mexico City, Guadalajara, Monterrey, and key U.S. border crossings. It has direct access to key highways such as Federal Highway 57 and modern rail networks. Its central location also ensures competitive distances to Mexico’s main ports: approximately 750 km to Lázaro Cárdenas, 700 km to Manzanillo, and 650 km to Veracruz, strengthening its logistics and export capabilities via both the Pacific and Gulf coasts.

Accelerating Industrial Momentum and Building Availability

This expansion is largely driven by a strong manufacturing sector. The region also boasts a Class-A facility inventory nearing 28 million square feet, with vacancy rates remaining low and highly competitive at around 2.5%.

Centerpiece: Automotive Cluster

In Q1 2025, San Luis Potosí produced 82,831 vehicles, operating at 70.8% capacity.

There were also USD 39.4M in new automotive investments, with expansions by Continental, JTEKT, and SL MEX, the latter opening a headlamp plant, creating 385 jobs. SLP remains a key automotive hub in Mexico.

Diversification: Aerospace & Beyond

Manufacturing here isn’t limited to cars. The aerospace sector is experiencing a boom cumulative FDI in aerospace now exceeding US$130 million, transforming SLP into a centralized supplier of high-precision aircraft components and systems. Over 4,100 new jobs across five major aerospace plants exemplify this trend. Meanwhile, electronics, medical devices, appliances, and food-processing niches continue to expand.

A Well-Prepared Workforce

Approximately 20% of San Luis Potosí’s 1.2 million economically active residents work in manufacturing, providing the region with a strong and stable labor force. This strength is further reinforced by industry-education partnerships, including dual-training programs developed with BMW, Cummins, local universities, and technical institutes, which focus on enhancing skills in mechatronics, materials, and automation.

Competitive Operations & Infrastructure

San Luis Potosí boasts a highly competitive operational environment supported by modern infrastructure and a strategic geographic location. The state is well-connected through major federal highways and rail networks, facilitating efficient access to key seaports such as Manzanillo and Altamira, the U.S. border, and central Mexico. Additionally, it benefits from a growing international airport and a portfolio of well-developed industrial parks equipped with world-class facilities and utilities.

As of May 2025, data from Solili reports that the average industrial lease rate in San Luis Potosí stands at approximately USD 5.58 per square meter per month (around USD 0.52 per square foot per month), positioning the state as one of the most cost-competitive industrial rental markets in Mexico.

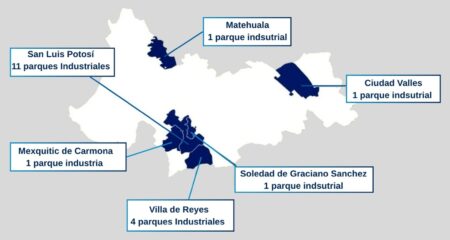

In 2025, the state has at least 25 industrial parks (both public and private), with 18 currently operational across seven key municipalities.

Since 2022, six new parks have been inaugurated, with more under development in Villa de Reyes, Santa María del Río, and Mexquitic de Carmona.

Government Incentives & Business Climate

Both federal and state authorities extend tax-related incentives or other types of incentives. SLP’s business environment is further acclaimed for political and labor stability, streamlined permitting, and active recruitment support. In the second quarter of 2024, San Luis Potosí attracted USD 1.064 billion in FDI, representing 3% of the national total, positioning it as the seventh state to receive the most investment in that period.

Why Manufacturers Should Take Notice

San Luis Potosí has transformed into a compelling site for manufacturers seeking scalability, regional connectivity, and stable, cost-effective production. Its rapidly evolving ecosystem, anchored by global OEMs, diversified into high-tech sectors, and underpinned by an avowed workforce, positions it as a rising star in Mexico’s industrial narrative. As companies pivot forward, SLP offers an environment equally rich in promise and substance.

If you want more detailed information or personalized guidance about investing and manufacturing opportunities in San Luis Potosí, consider reaching out to Mexcentrix, with headquarters in San Luis Potosi, is a trusted partner that specializes in easing business expansions in the region. Their expert insights and hands-on support can help you navigate the local landscape and maximize your success in this vibrant market. Contact us!

The Swiss company Franke Group, which specializes in solutions for kitchens and residential spaces, opened a new plant in San Luis Potosí as part of its global expansion strategy.

The project involved an investment of $82 million and is expected to generate more than 500 jobs, representing a significant boost to the region’s productive sector and a firm step in the company’s consolidation in the Americas.

SwissCham Mexico supports Swiss industrial expansion

The opening ceremony was attended by Emilia Pfeiffer, general director, and Valentin Pfyffer, manager for Bajío and Occidente of the Swiss-Mexican Chamber of Commerce and Industry (SwissCham Mexico), who supported the growth of Swiss companies in the country.

The business chamber highlighted that Mexico continues to consolidate itself as a strategic destination for innovation, production, and development for companies with a global focus such as Franke.

The opening of this plant reaffirms the group’s commitment to the Mexican market and its confidence in the country’s industrial environment.

About Franke Group

Franke Group is a Swiss company founded in 1911, specializing in the development of innovative solutions for domestic kitchens, public bathrooms, and professional service spaces, such as cafeterias and industrial kitchens. With a presence in more than 30 countries and over 60 subsidiaries, Franke is part of the Artemis Group and operates through divisions such as Franke Home Solutions, Franke Foodservice Systems, and Franke Water Systems. Its approach combines functionality, design, and sustainability, integrating advanced technology to offer durable and efficient products aligned with global quality standards.

Source: Mexico Industry

Executives from both companies presented the alliance to more than 20 Chinese companies in SLP, with the support of state and municipal authorities.

Mexcentrix, a firm specializing in helping foreign companies establish industrial operations in Mexico through schemes such as shelters, contract manufacturing, and regulatory compliance services, and the law firm Mendizábal & Valdés, recognized for its personalized and specialized service to domestic and foreign companies, formalized a strategic alliance on Friday, June 20, to strengthen the services they offer their clients.

The company Mexcentrix, represented by its director Jesús Octaviano Aguirre, and the firm Mendizábal & Valdés, represented by Carlos Valdés and Diego Valdés, highlighted that this collaboration will allow them to integrate legal, tax, immigration, and labor services with a business focus, in addition to providing certainty and legal support to companies established or in the process of setting up operations in Mexico.

During the dinner, more than 20 CEOs and executives from Chinese companies with a presence in San Luis Potosí participated in the presentation of this new strategic alliance. There, representatives of Mexcentrix—with extensive experience in attracting foreign direct investment, project management, and operational consulting—shared their joint vision for facilitating the expansion of international businesses in Mexico, with an emphasis on legal, tax, and regulatory processes that are critical to successful operation.

The event was also attended by local and state authorities, including the Secretary of Economic Development for the State, Jesús Salvador González Martínez; the Director of Economic Development for the Municipality of Villa de Reyes, Gerardo Alfonso Rodríguez Baldazo; and Congressman Luis Emilio Rosas Montiel, President of the Economic and Social Development Commission of the State Congress.

All recognized the value of this private synergy as a driver for attracting and consolidating foreign investment in San Luis Potosí.

The representatives of both firms agreed that the growth of Asian companies in the region, particularly in the automotive and advanced manufacturing sectors, requires integrated professional solutions that allow them to start operations efficiently, safely, and in full compliance with Mexican regulations.

With this alliance, Mexcentrix and Mendizábal & Valdés reaffirm their commitment to the economic development of San Luis Potosí and their role as strategic allies of the foreign business community. The combination of operational experience and legal support seeks to consolidate a competitive environment for investment, strengthening the state’s position as an attractive destination for new industrial projects.

Source: El Heraldo

In today’s fast-paced global market, manufacturers constantly seek ways to cut costs without sacrificing quality or efficiency. One of the most effective approaches is to expand or relocate operations to Mexico, a country that offers an ideal combination of low cost and a skilled workforce.

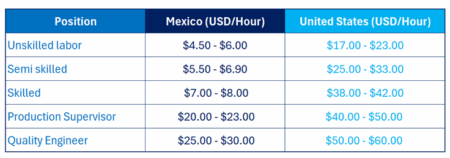

Mexico’s Manufacturing Wages vs. U.S.

When comparing manufacturing wages, Mexico offers a clear cost advantage over the U.S, allowing companies to keep margins while scaling operations.

Both México’s and the United States’ labor costs vary per location and industry; nevertheless, below you can find approximate fully burdened rates for some common positions in the manufacturing industry:

United States Labor Costs Source: U.S. Bureau of Labor Statistics, Occupational Employment and Wage Statistics (OEWS) Profiles, May 2024 Profiles.

A Skilled and Growing Workforce

Mexico continues to invest in education and vocational programs, producing a growing pipeline of engineers and technicians. Many companies from Germany and its surrounding have benefited from the dual education model.

Furthermore, regions such as Bajío, Monterrey, and Tijuana are recognized for their industrial ecosystems and technical universities, making them attractive hubs for advanced manufacturing.

This ongoing investment in human capital ensures that manufacturers can count on a reliable workforce to support long-term growth.

Regional Flexibility for Operational Strategy

Mexico’s labor market also provides geographic flexibility. While northern border areas often have higher labor rates due to increased demand and cost of living, central and southern regions can offer more affordable options while still maintaining access to infrastructure and skilled labor. In the southern region there is still a need for training and qualifying personnel for the manufacturing industry.

This diversity allows manufacturers to customize their site selection based on budget, logistics, and access to supply chains or export routes.

Why Mexico Makes Strategic Sense

In addition to finding cost savings in real estate and logistics costs, with its affordable and skilled labor, Mexico has become a go-to destination for manufacturers aiming to reduce costs and increase efficiency. It’s not just a matter of lowering expenses; it’s about building a scalable, resilient, and responsive supply chain close to major consumer markets.

Moreover, operating under a shelter company like Mexcentrix, we can help you save up to 40% in the start-up phase and up to 20%

Ready to Establish Your Operations in Mexico?

At Mexcentrix, we help international companies navigate every step of the manufacturing setup process from site selection and legal compliance to full shelter services and operational support. Contact us today to learn how we can support your success in Mexico.

The automotive sector in San Luis Potosí has attracted a new international investment with the arrival of SL MEX, a Korean company that will invest US$45 million in the first phase to establish a production plant in the Logistik II industrial park in Villa de Reyes.

The announcement was made by the state governor, Ricardo Gallardo Cardona, who highlighted that the installation of SL MEX represents a firm step towards the diversification and modernization of the automotive industry in San Luis Potosí, consolidating the state as one of the main hubs for foreign investment in Mexico.

The plant, led by Kyungsoo Koo, president of SL MEX, has already been completed and has a total area of 8.9 hectares, including a building of more than 14,000 square meters. From this strategic location, automotive headlight modules will be manufactured for major global brands such as BMW, General Motors, Hyundai, and Kia.

With 12 production lines and an installed capacity to manufacture up to one million modules per year, the company will generate 385 direct jobs, strengthening regional economic development and adding value to the automotive supply chain.

According to the company’s projections, operations will begin in the coming months, and annual sales of $144 million are expected by 2030, a figure that will position San Luis Potosí as a key hub in the global supply of automotive lighting components.

Source: Mexico Now

Mexico has established itself as one of the main destinations for foreign investment in the aerospace industry. According to data from the Mexican Aerospace Industry Federation (FEMIA), the Mexican aerospace market is valued at US$11.2 billion and is projected to reach US$22.7 billion by 2029, driven by annual growth of more than 15 percent.

According to the Mexico Industry portal, at the end of the first half of 2024, 386 aerospace companies were operating in the country in 19 states, with 370 specialized plants generating more than 50,000 direct jobs and 190,000 indirect jobs. This progress has positioned Mexico as the world’s twelfth largest exporter of aerospace components.

Against this backdrop, the 2025 Mexico Aerospace Fair (FAMEX), held from April 23 to 26 at the No. 1 Military Air Base in Santa Lucía, reaffirmed the country’s strategic position in the sector. It brought together 337 companies, representatives from 48 countries, and 73 aircraft, including models such as the F-35 and the Airbus A400M.

Twenty air forces, 12 universities, and diplomats from 40 nations also participated. The fair was the scene of national innovations, such as the Pegasus PE-210A, the first aircraft designed and manufactured in Mexico by Oaxaca Aerospace. Designed for training and tactical missions, it incorporates advanced technology and can be adapted to electric or hydrogen engines, anticipating sustainable aviation.

Horizontec, a company from Celaya, Guanajuato, was also recognized with the “Made in Mexico” certificate for its Halcón 2 aircraft, assembled with high technology and in-house development. In addition, it promoted sustainability in aviation, rewarding Sustainable Aviation Fuel (SAF) projects with methods such as Alcohol-to-Jet (ATJ) and Furans to Jet (FTJ). These initiatives seek to reduce the environmental footprint and promote a clean and sustainable future.

International cooperation was key at FAMEX 2025. Foreign governments and companies explored strategic alliances. Baja California, as an aerospace hub, signed agreements with SAFRAN and Meloche Group, reinforcing its position as a center for foreign investment.

Delphine Borione, French ambassador, highlighted that her country has invested almost $280 million in the Mexican aerospace sector, positioning itself as the second largest foreign investor. She also highlighted partnerships with universities to train qualified human capital.

Florence Copin, from Safran, emphasized that this company is the leading aerospace employer in Mexico, present in four states and accounting for 25 percent of the sector’s workforce, employing nearly 15,000 people. She reaffirmed her commitment to innovation, excellence, and the professional development of Mexicans.

Source: Mexico Now

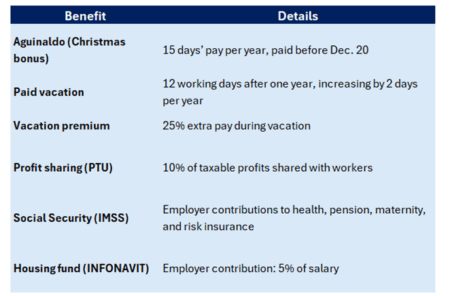

One of the main advantages when nearshoring to Mexico is its cost-effective labor market. However, it’s important to understand the country’s labor framework to stay compliant and build a productive workforce. Here’s what you need to know:

Key Aspects of Mexican Labor Law

Mexico’s Federal Labor Law (Ley Federal del Trabajo or LFT) is the primary legal framework that governs labor relations in the country. It sets out the rights and obligations of both employees and employers, aiming to promote fair labor practices, decent working conditions, and social justice. The law applies to most employment relationships in Mexico and covers various aspects such as employment contracts, wages, working hours, rest periods, occupational safety, and procedures for labor disputes.

Key Principles of Mexican Labor Law:

Work Shifts and Hour Limits

The law classifies work shifts into three main categories: daytime, nighttime, and mixed shifts, each with specific rules regarding allowable working hours. These classifications are essential for ensuring compliance with labor standards and protecting workers well being. Below is an overview of each shift type:

Daytime

Night shift

Mixed Workday

Overtime Pay

Hours worked beyond the established workday are considered overtime and must be paid as follows:

The law limits overtime to a maximum of 3 hours per day and no more than 3 times per week, meaning a total of 9 overtime hours per week.

Trial Periods

According to Article 39-A of the Federal Labor Law (LFT), when entering into an initial contract for an indefinite period or more than 180 days, a trial period may be established with the following maximum durations:

During the probationary period, the employer may terminate the employment relationship without liability for payment of severance (liquidation), provided that there is objective evidence of lack of aptitude or performance, and the legal procedure is respected.

Minimum Wage

As of January 1, 2025, the official minimum wages set by the National Minimum Wage Commission (CONASAMI) are:

Mandatory Benefits by Law

Mexican employers are legally obligated to provide the following benefits:

Common Additional Benefits Offered by Employers

Many companies offer voluntary benefits beyond what the law mandates to remain competitive. These include:

Employee Dismissal

Dismissal in Mexico can be with cause or without cause, but either way, it must follow legal protocol:

Final Recommendations

Here are some best practices for hiring in Mexico:

Mexico’s labor landscape is structured to protect employees but remains employer-friendly when properly managed. Understanding your obligations and offering attractive benefits will position your company as a competitive and responsible employer. For more insights into how shelter companies can help your business, consider contacting Mexcentrix and exploring case studies of companies that have successfully leveraged this model.

Mexcentirx can guarantee 100% compliance with labor laws and facilitate the process of hiring in Mexico. Contact us!

Following the publication of the tariff rules on Tuesday, it is now official that Mexico, Canada and the United Kingdom are the countries that, to date, have the best access conditions to the U.S. market, although the levies themselves go against the T-MEC.

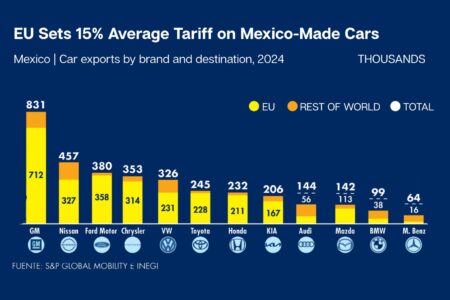

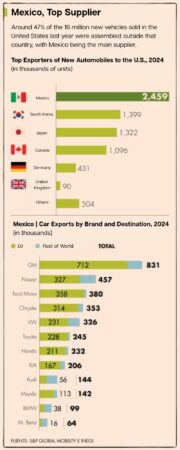

The United States reduced from 25% to 15% the approximate average tariff on imported cars originating in Mexico, informed Marcelo Ebrard, Secretary of Economy.

The lower rate is conditional on the vehicles complying with the rules of origin of the Mexico-U.S.-Canada Agreement (T-MEC). Otherwise, imports will pay a 25 percent tariff.

President Donald Trump imposed a 25 percent tariff on certain auto imports, effective April 3, 2025, and certain auto parts imports effective May 3, 2025.

For autos, the United States applies exceptions to three nations: “a discounted tariff” to Mexico and Canada, and an annual quota for the United Kingdom of 100,000 units with a 10 percent tariff.

Regarding the former, the U.S. Department of Commerce published this Tuesday in the official gazette (Federal Register) the procedures to obtain discounts in tariffs on auto imports, which only apply to Mexico and Canada if they comply with the rules of the T-MEC and can be retroactive as of April 3, 2025.

“Vehicles that are made in Mexico will have a discount from that tariff (…) by around 40%, but it may be that in some cases it will be higher,” he said during a COA conference in Mexico City.

He explained it in this other way: “From now on and from the time this new rule goes into effect, vehicles that are made in Mexico and go to the United States, instead of paying 25 percent, will pay around 15 percent.”

Trump’s Proclamation states that automobiles that qualify for preferential tariff treatment under T-MEC may submit documentation to the Department of Commerce to identify the U.S. content in each model imported into the United States.

In 2024, the United States imported approximately 8.1 million automobiles from the world with values totaling approximately $248.8 billion, based on the categories of automobiles described in Annex I of the referenced Proclamation.

Among these automobiles, approximately 3.7 million (approximately 46%) are included in U.S. trade statistics that have been declared eligible for T-MEC preference.

Within that volume, 1.07 million of these eligible cars were imported from Canada, and 2.66 million cars were imported from Mexico.

In theory, these discounts represent the upper limit of cars that could qualify for tariff exemptions on the U.S. content of these imports.

According to analysts, the United States violates the T-MEC by imposing tariffs on cars imported from Mexico or Canada that comply with the T-MEC.

“Today an agreement is published that I see as very positive, which establishes preferential treatment for the automotive industry in Mexico and Canada, in relation to the automotive industry of other countries in the world,” said Ebrard.

Then he added: “This decree, which is being published today, says that on average between 40, maybe 50% of the tariffs for automotive vehicles will be reduced, 40 to 50%, with respect to other countries in the world”.

At the event, Susan Segal, President and CEO of the Americas Society/Council of the Americas, commented: “I am convinced that the concept of an integrated North America, the T-MEC will continue, because in the end it continues to benefit all three countries.

Source: El Economista

The entity reaffirms its position as an automotive hub with the inauguration of the second industrial plant of San Luis Dasung, a subsidiary of the Malaysian group MK TRON, located in the Logistik II Park.

The expansion represents an investment of US$9 million and the generation of 250 new direct jobs, bringing the company’s total workforce to 700 workers.

Dedicated to the components for the automotive industry in Mexico and the United States, San Luis Dasung strengthens its operational capacity with an industrial complex equipped with Korean automated technology.

This advanced infrastructure not only improves production efficiency, but also demands specialized technical personnel, generating well-paying jobs and raising the region’s industrial profile.

During the inaugural event, the head of the Secretariat of Economic Development (Sedeco), Jesús Salvador González Martínez, emphasized that San Luis Dasung’s investment reflects the confidence of foreign capital in the state. He also highlighted the importance of collaboration between the public and private sectors as a key to consolidate San Luis Potosí as a pole of attraction for new investments.

With this expansion, San Luis Dasung not only expands its footprint in Mexico, but also boosts regional development through skilled technical employment, technological innovation and export-oriented supply chains.

Source: Mexico Now