On May 1, 2021, the SAT released through its portal, the “Part Letter Complement”, which must be incorporated into the transfer or entry CFDI that is issued for the transport of goods, with the In order to prove the legal possession of the transported goods and providing information on their origin and destination.

Carta Porte

Rule 2.7.1.9 of the Miscellaneous Fiscal Resolution (RMF) provides for the obligation to add the complement of the Letter of Carriage to the transfer or entry CFDI that is issued for the transport of goods.

According to the tax authorities, the purpose of the bill of lading supplement is to know precisely the information of the goods that are transferred in the national territory, their origin, midpoints, destinations, owners, tenants and operators involved in the transfer of the goods, and likewise its purpose is to combat informal trade and smuggling.

Who should issue the CFDI with Carta Porte complement?

- Companies dedicated to the transfer of goods or merchandise must issue an INCOME type CFDI with a bill of lading complement. The income-type CFDI is issued for the provision of motor transport services, and stated the obtaining of an income for these services.

- The owners of goods or merchandise who act as intermediaries or transport agents and move merchandise or owners of goods and merchandise that move merchandise with their own means, must issue a TRANSFER type CFDI with a bill of lading complement. The transfer-type CFDI is issued to cover the transfer of merchandise within the national territory.

What should the Cara Porte Include?

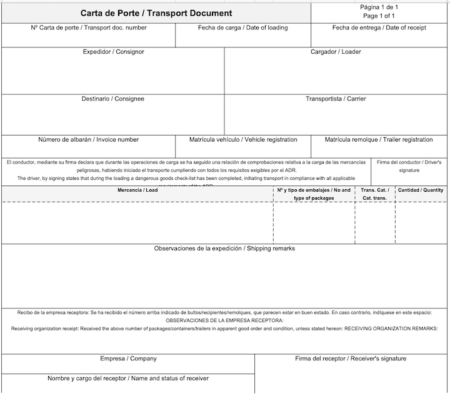

It must include the following data or information:

-Name and data of the exporter of the merchandise.

-Name and details of the carrier (carrier) of the merchandise.

-Receiver of the merchandise.

-Quantity and description of the merchandise (including type, weight, brand, number of packages or units, etc.).

-Value or price of the products.

-Date of transport and when the expedition is made.

-The place of delivery.

-Place and term in which delivery is made to the consignee.

-Compensation to be paid by the carrier in case of delay, if there is an agreement on this point.

-Transfer taxes.

-Customs information.

Entry into Force

On September 21, 2021, the first anticipated version of the Third Resolution of Modifications to the Miscellaneous Tax Resolution for 2021 (RMF) was published on the Internet portal of the Tax Administration Service, in which the entry into force is modified from September 30 to December 1, 2021.

As of the entry into force, goods or merchandise transport services with an income-type CFDI without a “Carta Porte” supplement will not be deductible because they do not meet the tax requirements for the deductibility of tax receipts.

For more information regarding the subject, please contact us.