Industries Benefiting from Nearshoring in Mexico

What is Nearshoring ?

Nearshoring means transferring your business operations across national borders to another country that is close in proximity, with relative small time -zone and cultural differences. This in order to be more cost- effective and save time.

The commercial war between Us and China which started in 2018, together with the COVID pandemic in which many companies suffered from logistics setbacks in addition to high costs of ocean freights, led companies to reconsider their manufacturing location abroad.

Nowadays it is considered that the war between Russia and Ukraine is also limiting the availability of raw materials, so companies had to consider buying raw materials from another suppliers.

Therefore, Mexico has boomed as a region for nearshoring operations.

Nearshoring in Mexico

Due to the abovementioned, and the different advantages Mexico has to offer including low labor costs and access to qualified personnel, its free trade agreements (FTA), proximity to US, among others; Mexico has positioned itself as an attractive country for companies wishing to relocate their operations in our region.

By the end of 2022, the Ministry of Economy in Mexico reported that there were more than 400 companies interested in establishing themselves in Mexico.

The main industries that benefit from nearshoring in Mexico are:

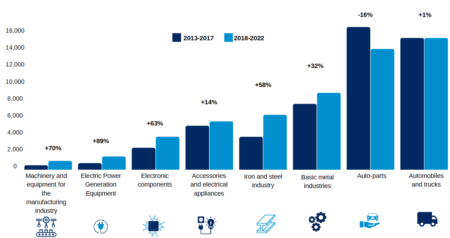

Although, the automotive and auto parts industry are still the main source of foreign direct investment (FDI), we have seen how in the last years the FDI sources have increased in other industries such as the electronics and appliances and the iron and steel industry. As shown in the graph below:

Manufacturing FDI

Accumulated figures between 2013- 2017 and 2018 – 2022 (Millions of USD)

Source: Deloitte (2023), Nearshoring in Mexico. Obtained from https://www2.deloitte.com/mx/es/pages/finance/articles/nearshoring-en-mexico-los-numeros-detras-del-relato.html

Overview of some the main industries benefiting from nearshoring to Mexico

-

Automotive Industry

As shown in the graph below the automotive and auto parts industry is the main source of FDI, it is also one of Mexico´s most significant industries comprising 3.5% of Mexico´s total GDP and 20% of the manufacturing GDP.

Hence, the automotive industry was highly affected by the pandemic, Mexico produces over three million automobiles a year, ranking seventh among all passenger vehicle producers worldwide.

Moreover, according to AMIA (Mexican Association of the Automotive Industry) there are currently 22 vehicle plants, 10 motors plants and 7 transmissions plants in Mexico, with an installed capacity of over 5 million vehicle per year. 90% of the vehicles produced are exported. Furthermore, it is the 4th largest producer of automotive parts.

Currently, nearshoring is attracting investment in the automotive industry with a big focus on the electric vehicle segment, as OEMs such as TESLA, BMW among others, are announcing their investment in Mexico within this sector, suppliers of these OEMs are also coming to Mexico to install their manufacturing facilities.

Additionally, companies from Germany, Spain, Switzerland, United States and Canada are relocating their operations from China to Mexico, in order to obtain a better access to the US market and though accelerate the process of moving towards the manufacture of electric vehicles in Mexico.

-

Aviation and Aerospace Manufacturing Industry

From creating components, tiny parts, and harnesses to producing airframes, flight surfaces, small drones, and flight control and avionic assemblies, Mexico has strengthened its aerospace manufacturing capabilities.

The aircraft sector in Mexico is likewise heavily influenced by international companies. According to the Mexican Federation of the Aerospace Industry (FEMIA), Mexico’s aerospace sector grew from 100 manufacturing firms and organizations in 2004 to more than 370 by 2020.

As the 14th largest aerospace supplier globally, about 80% of the production of the aerospace industry in Mexico is exported. Even though the aerospace industry was highly affected by the pandemic, it is in clear recovery. The Mexican Federation of the Aerospace Industry -FEMIA forecasts that by the end of 2023, the pre-pandemic export levels of 9.6 billion dollars will be recovered.

Additionally, aerospace companies in US and Canada are requesting presence of the supplier in the regions nearby, which presents a great opportunity for Mexico, due to its proximity and as it already counts with an important cluster in this industry.

-

Electronics & Appliances Industry

The electronics and appliance industry plays also an important role, as it is one of the fastest growing industries in Mexico in regards to FDI and export potential. The industry currently represents 5.3% of Mexico’s manufacturing GDP.

Consequently, according to Data Mexico, in 2022, the total trade exchange of electrical and electronic equipment was US$213,364M. The main trade destinations being: the United States (US$84,846M), Canada (US$1,905M), China (US$1,579M), the Netherlands (US$785M) and Brazil (US$584M). (Data Mexico, 2023)

Mexico counts with a diverse electronics manufacturing services industry. According to Mexico’s National Statistical Directory of Economic Units (DENUE) there are more than 1,000 firms in Mexico that manufacture computer and communication equipment, components, and accessories in the electronics and appliance industry. It is considered this number will keep growing due to Mexico´s strategic location, the USMCA and the additional advantages for nearshoring to Mexico.

-

Medical Device Manufacturing Industry

Currently, Mexico is the 8th largest manufacturer in the world of medical devices and is currently the top exporter of medical devices to the United States.

According to DENUE 2022, Manufacture of Pharmaceutical Products registered 925 economic units. The states with the highest number of economic units were:

· Mexico City (249)

· Jalisco (158)

· State of Mexico (102).

Some of the top medical device companies installed in Mexico include: Becton Dickinson, Siemens, Johnson & Johnson, Philips, GE Medical Systems, among others.

Altogether, it is expected that the medical device market will grow at a CAGR of 4.9% from 2023 to 2028. This presents important opportunities for companies within this sector who are looking to gain market share, leading to an increase in the number of medical device manufacturing companies that are expanding or relocating to Mexico.

Is your company looking to nearshore its manufacturing operations to Mexico?

Mexcentrix shelter services can help you run operations efficiently, while at the same time reducing risks and costs. Contact us!