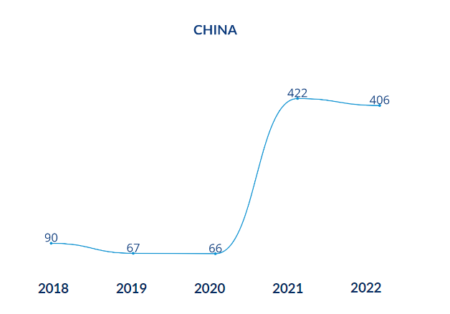

Nearshoring has had an important impact in Mexico manufacturing industry in the last years, as the number of companies looking to nearshore operations to Mexico has increased significantly, including an increase in FDI from Chinese companies, as shown in the graph below.

New Investments in Mexico per year (US $M)

Fuente: Deloitte (2023): Nearshoring en México.

Nearshoring Impact

According to a study performed by Morgan Stanley, it believed that FDI driven by nearshoring could reach about $46 billion in the next five years, helping boost Mexico’s annual GDP growth to around 3% in 2025 to 2027.

Why Chinese Companies are Choosing Nearshoring to Mexico.

United Stated and China Trade War

Chinese companies started to consider Mexico as an ideal place to establish manufacturing operations since 2018 when Donald Trump, America’s president at the time, launched a trade war that included raising tariffs on imports from several products from China.

USMCA

The United States-Mexico-Canada Agreement increased regional value content requirements for products to be considered as North America origin, by those means, manufacturers had to think about relocating their supply chains.

Moreover, Chinese companies by establishing operations in Mexico, can take advantage of the USMCA (United States-Mexico-Canada Agreement) preferential duties, if complying with the rules of origin.

Geographical Proximity and Economic Stability

Mexico’s strategic geographic location adjacent to the United States, Canada, and Latin America is a cornerstone of its appeal. This proximity minimizes logistical complexities, reduces transportation costs, provides time zone alignment and ensures easier access to key markets.

Chinese companies are moving production closer to customers in United States to limit their vulnerability and risks of supply chain disruptions, as well as geopolitical tensions. Furthermore, some of these customers are demanding their suppliers to establish a plant in North America or nearby, to minimize the risks of logistics disruptions that companies were exposed in the pandemic.

Cost-effectiveness and Operational Competence

Mexico remains a popular destination for nearshoring due to cost-effectiveness, mainly due to its low labor costs and availability of qualified personnel, which allows companies to maximize operational costs while upholding high standards.

Government Support and Investment Initiatives

The Mexican government has proactively implemented policies and incentives to encourage foreign investment. Initiatives aimed at improving infrastructure, fostering innovation, and providing tax incentives for businesses have created a favorable business environment. These incentives provide confidence among investors and further solidify Mexico’s position as a nearshoring hotspot.

Perspective for the future

As before mentioned, Nearshoring to Mexico seems to be headed in a favorable direction. With companies looking for maximize cost savings and minimize risks, Mexico´s strategic advantages will probably help the country stay on top as a nearshoring destination.

Mexico’s rise in nearshoring is, in short, more than a trend; it’s a calculated decision that will shape the nature of global business in the future.