MEXICO – US TRADE RELATIONSHIP

U.S. trade with Mexico and China, has shifted in the last years; Mexico is currently the United States’ largest source of imports. According to Investopedia, the United States imported approximately $506 billion worth of goods from Mexico in 2024.

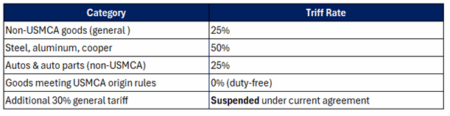

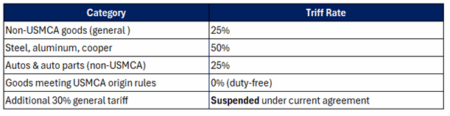

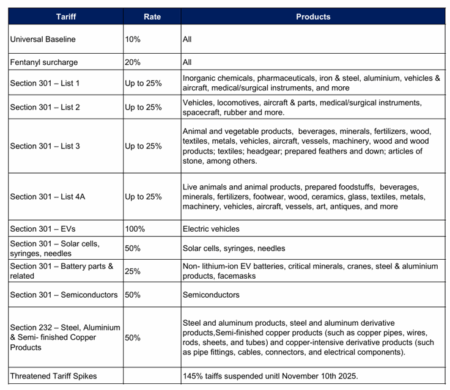

As part of the United States’ strategy, the imposed tariffs since the beginning of 2025 have included Mexico. Tariffs of around 25% on imports from Mexico were enacted under executive orders, targeting sectors such as automotive, agricultural products, and manufactured goods. Below is a summary of current tariffs applicable to Mexico:

However, despite these new measures, more than 84% of Mexico’s exports to the U.S. remain duty-free under the provisions of the USMCA. Only the remaining 16%—primarily non-USMCA goods such as certain auto components, steel, and aluminum—are subject to the 25% tariff.

CHINA – US TRADE RELATIONSHIP

As stated before, U.S trade with Mexico and China has changed in teh last years. In regards to China, since the start of the U.S.–China trade war, bilateral trade between the two countries has steadily declined. Many companies have responded by shifting production closer to the United States through nearshoring, with Mexico emerging as a primary destination. As a result, Mexico has now overtaken China as the United States’ top trading partner.

According to The Wall Street Journal, U.S. imports from China fell from 22% of total imports in 2018 to around 12% by early 2025. In value terms, imports dropped from $505 billion in 2018 to $439 billion in 2024—a $66 billion decline. This underscores the significant impact tariffs have had on the U.S.–China trade relationship, an effect that is expected to persist.

US – CHINA TARIFFS

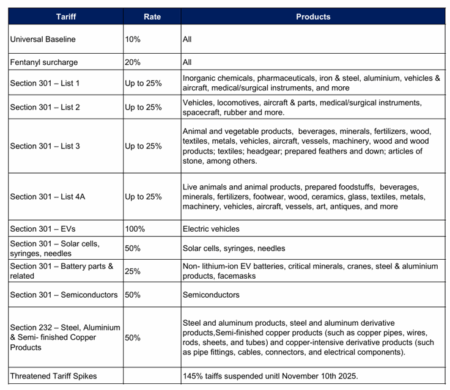

On August 12, the United States and China agreed to extend their tariff truce for another 90 days, until November 10, 2025, postponing the implementation of additional duties on each other’s goods. This agreement temporarily eases tensions in a trade relationship that has been marked by escalating tariffs, retaliatory measures, and mounting uncertainty for businesses.

Futhermore, this extension prevents U.S. tariffs on Chinese products from surging to 145%, while Chinese tariffs on U.S. goods were set to reach 125%—levels that experts considered would have created a near-total trade embargo between the two economies, severely disrupting global supply chains, increasing consumer prices, and placing additional pressure on companies reliant on cross-Pacific trade. In addition, the potential breakdown of trade flows could have pushed businesses to accelerate diversification strategies, benefiting alternative manufacturing hubs like Mexico.

As of now, the US tariffs imposed will remain as follows:

IMPLICATIONS FOR CHINESE INVESTORS IN MEXICO

Mexico has been among the countries least affected by recent U.S. tariffs, largely thanks to the protections offered under the USMCA. Establishing operations in Mexico can be highly advantageous—particularly when the finished goods manufactured meet the USMCA rules of origin. Mexcentrix can assist by analyzing Bills of Materials (BOMs) to verify whether a product qualifies as USMCA-origin, potentially delivering significant tariff savings compared to the rates currently applied to Chinese products.

While USMCA provisions shield the majority of Mexican exports from new duties, certain sectors—most notably automotive—continue to face substantial challenges. Nevertheless, investor sentiment remains strong, with many projects moving forward. This is driven by the competitive advantages of USMCA protections and the deferred implementation of some tariff measures, even as uncertainty lingers for select foreign investors.

For all countries, balancing protectionist policies with the benefits of integrated supply chains will be key to sustaining growth, stability, and competitive advantage in the global market.

For companies navigating these new challenges, Mexcentrix Shelter Services can provide the expertise and operational support needed to establish manufacturing operations in Mexico efficiently. From compliance, cost optimization, risk reduction, and supply chain integration, Mexcentrix helps businesses adapt to changing trade conditions.

Contact us for more information on Mexico’s Shelter Services and the advantages of establishing opertions with Mexcentrix.