Mexico has rapidly become a significant hub for electronics manufacturing, driven by a combination of strategic location, cost-effective labor, skilled workforce, and favorable trade agreements. This blog explores the factors behind Mexico’s rise in the global electronics manufacturing landscape, the challenges it faces, and the potential for future growth.

Strategic Location and Proximity to the U.S.

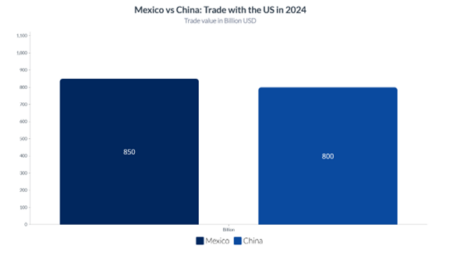

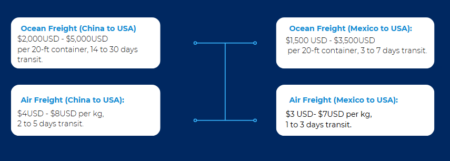

One of Mexico’s most significant advantages is its proximity to the United States, the world’s largest consumer market. This geographical advantage facilitates just-in-time delivery, reduces shipping costs, and enhances the ability to respond quickly to market demands. The shorter supply chains compared to those in Asia offer manufacturers the flexibility to manage production more efficiently, especially in the context of the ongoing global supply chain disruptions.

Cost-Effective and Skilled Labor Force

Mexico offers a competitive labor market with wages significantly lower than those in the U.S. or Europe but higher than in many Asian countries. This cost-effectiveness does not come at the expense of quality. Mexico’s workforce is known for its technical skills, especially in electronics, automotive, and aerospace manufacturing. Numerous technical schools and universities in Mexico offer specialized programs in engineering and electronics, ensuring a steady supply of skilled workers.

Trade Agreements and Regulatory Environment

Mexico’s participation in the United States-Mexico-Canada Agreement (USMCA) and its network of free trade agreements with over 50 countries provide manufacturers with tariff-free access to key markets. This regulatory environment makes Mexico an attractive destination for foreign direct investment (FDI), as companies can produce goods in Mexico and export them globally with fewer trade barriers.

Growing Infrastructure and Technology Ecosystem

Mexico’s infrastructure, particularly in its northern industrial zones, has seen significant improvements. Modern industrial parks, reliable energy supplies, and robust transportation networks are crucial for high-tech manufacturing. Moreover, the Mexican government has been proactive in supporting the development of a technology ecosystem, promoting innovation and investment in electronics manufacturing.

Challenges Facing the Industry

Despite these advantages, Mexico’s electronics manufacturing sector faces several challenges, including political instability due to the change of presdient can create uncertainty for investors. Additionally, in some cases, Mexico faces challenges in intellectual property protection, which can be a concern for companies dealing with high-value, innovative products.

The Main Electronics Manufacturing companies in Mexico and where are they located

Mexico is an important center for electronics manufacturing, with many companies operating in the country. Here are some of the main companies and their locations:

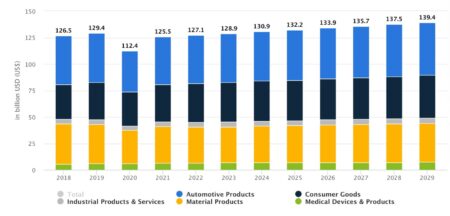

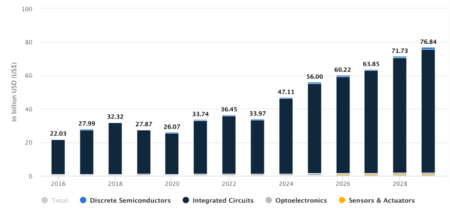

The Most Manufactured Electronic Products in Mexico

The Future of Electronics Manufacturing in Mexico

The future of electronics manufacturing in Mexico looks promising. The ongoing trend of nearshoring, where companies relocate production closer to their home markets, is likely to benefit Mexico. As companies seek to mitigate risks associated with long supply chains, Mexico’s strategic advantages become even more pronounced.

Investments in education and infrastructure, coupled with government support for innovation, will be key to sustaining growth. Additionally, Mexico’s ability to adapt to global trends, such as the increasing demand for green and sustainable manufacturing practices, will determine its long-term success in the electronics manufacturing sector.

Mexico’s rise as a global hub for electronics manufacturing is the result of a strategic blend of location, skilled labor, favorable trade agreements, and growing infrastructure. While challenges remain, the country’s potential for growth is significant. As global companies continue to seek efficient and reliable production bases, Mexico is poised to play an increasingly important role in the electronics manufacturing industry.

Interested in Manufacturing Electronics in Mexico?

If you are a company in the electronics industry interested in manufacturing in Mexico, it is important to have a reliable partner for a hassle-free start of operations. Mexcentrix can help you by facilitating the process through shelter services and flexible solutions that guarantee long-term success. Contact us!