Mexico’s Supply Chain Strengths and Solutions

In 2020 we experienced one of the greatest challenges in the world economy, the COVID – 19 pandemic, which brought big challenges to the entire global value chain, and Mexico was no exception.

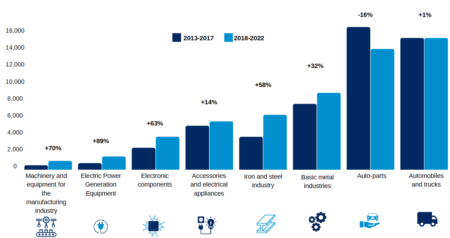

The response from the manufacturing industry was immediate, many transnational companies that had their production in China, began moving operations to the American continent to avoid interruptions in their supply chain, as well as to reduce their dependence on overseas industrial zones, highly affected by the pandemic.

Nearshoring

It´s in this context, Mexico reappears on the international scene as an ideal destination for north American companies considering to nearshore their operations. Mexico was already an ideal destination due to its 13 free trade agreements signed with 50 countries, including the USMCA, low labor costs and its availability of qualified labor. While its proximity to the U.S. provides flexibility and simplifies many of the logistical challenges in reaching one of the world’s largest markets.

Furthermore, nearshoring has become the leading force and solution for supply chain disruptions in the post-covid era. By moving manufacturing to a low-cost country closer to corporate headquarters, companies can take advantage of the benefits of offshoring while reducing risk and simplifying supply chain management.

In addition to the already established and developed clusters in Mexico, such as the automotive industry, which clusters have a presence in almost every state in Mexico. Companies searching to establish operation in Mexico can benefit from the robust supply chain networks.

Mexico’s supply chain strengths:

Some of Mexico’s supply chain strengths include:

- Shorter shipping time. Due to the proximity to the US you will find shorter shipping times, which can result in fewer interruptions in the supply chain. Furthermore the communication between customer-supplier is in real time since the reduced time zone difference, which improves decision making process and efficiency.

- Reduced shipping costs. Overseas shipping has become more complicated and expensive. As above mentioned, the proximity to US offers a big opportunity in logistics costs reductions. For example, compared to China due to Mexico´s geographic location it represents approximately 75% less shipping times and costs. In addition to the fact that there are more types of transportation to choose from than shipping overseas.

- Less disruption in the supply chain. Again, taking advantage of the proximity to US, means the supply chain is shorter which reduces risks of problems and interruptions, such as delays.

Moreover, some years ago many companies based their strategic decision of expanding abroad based on a cost- driven approach. Due to some lessons learned from the pandemic among other situations, such as global container shortages and increase in prices, disruptions in the supply chain, companies are now basing their expansion strategies in minimizing risks and simplifying their supply chain.

Based on the above, manufacturing companies with target markets in the United States, by nearshoring the supply chain poses much fewer risks compared to those that extend overseas.

What’s next?

If you are looking to learn about the advantages that the Mexican market offers for your industry and take advantage of Mexico’s Supply Chain Strengths , you can contact Mexcentrix, we provide strategic guidance and shared business services for manufacturing companies in Mexico. We can get your company up and running in as few a 2 to 3 months.

Contact us for more information.