United States Reduces Tariffs on Cars to Mexico from 25 to 15%

Following the publication of the tariff rules on Tuesday, it is now official that Mexico, Canada and the United Kingdom are the countries that, to date, have the best access conditions to the U.S. market, although the levies themselves go against the T-MEC.

The United States reduced from 25% to 15% the approximate average tariff on imported cars originating in Mexico, informed Marcelo Ebrard, Secretary of Economy.

The lower rate is conditional on the vehicles complying with the rules of origin of the Mexico-U.S.-Canada Agreement (T-MEC). Otherwise, imports will pay a 25 percent tariff.

President Donald Trump imposed a 25 percent tariff on certain auto imports, effective April 3, 2025, and certain auto parts imports effective May 3, 2025.

For autos, the United States applies exceptions to three nations: “a discounted tariff” to Mexico and Canada, and an annual quota for the United Kingdom of 100,000 units with a 10 percent tariff.

Regarding the former, the U.S. Department of Commerce published this Tuesday in the official gazette (Federal Register) the procedures to obtain discounts in tariffs on auto imports, which only apply to Mexico and Canada if they comply with the rules of the T-MEC and can be retroactive as of April 3, 2025.

“Vehicles that are made in Mexico will have a discount from that tariff (…) by around 40%, but it may be that in some cases it will be higher,” he said during a COA conference in Mexico City.

He explained it in this other way: “From now on and from the time this new rule goes into effect, vehicles that are made in Mexico and go to the United States, instead of paying 25 percent, will pay around 15 percent.”

Trump’s Proclamation states that automobiles that qualify for preferential tariff treatment under T-MEC may submit documentation to the Department of Commerce to identify the U.S. content in each model imported into the United States.

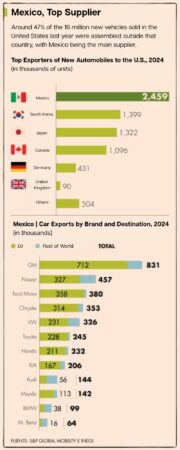

In 2024, the United States imported approximately 8.1 million automobiles from the world with values totaling approximately $248.8 billion, based on the categories of automobiles described in Annex I of the referenced Proclamation.

Among these automobiles, approximately 3.7 million (approximately 46%) are included in U.S. trade statistics that have been declared eligible for T-MEC preference.

Within that volume, 1.07 million of these eligible cars were imported from Canada, and 2.66 million cars were imported from Mexico.

In theory, these discounts represent the upper limit of cars that could qualify for tariff exemptions on the U.S. content of these imports.

According to analysts, the United States violates the T-MEC by imposing tariffs on cars imported from Mexico or Canada that comply with the T-MEC.

“Today an agreement is published that I see as very positive, which establishes preferential treatment for the automotive industry in Mexico and Canada, in relation to the automotive industry of other countries in the world,” said Ebrard.

Then he added: “This decree, which is being published today, says that on average between 40, maybe 50% of the tariffs for automotive vehicles will be reduced, 40 to 50%, with respect to other countries in the world”.

At the event, Susan Segal, President and CEO of the Americas Society/Council of the Americas, commented: “I am convinced that the concept of an integrated North America, the T-MEC will continue, because in the end it continues to benefit all three countries.

Source: El Economista